New Life Christian Outreach Celebrates 37 Years Of Ministry

Pastor John Pringle and his wife June founded New Life Christian Outreach in 1987 when they received clear direction from the Lord to do so. Close friends, Jim and Anabel Andres helped John and June start the church. They were told the church was to be an outreach to the people in the area, and throughout the last 30 years, they have done this in many ways.

Prior to this, John and June discipled with the Rev. Phillip Zampino for 3 years after their son Mark received 2 miraculous healings under his ministry and helped the Zampinos establish a ministry center in Libertytown, MD.

John also worked with Sid Roth’s ministry, Messianic Vision, and became a member of his board for many years. John was ordained by Sid as Pastor of New Life, and the church continues to maintain a relationship and support for Sid’s ministry. http://www.sidroth.org/site/PageServer

Last Week's Message

Events & Announcements

Bible Study

Bible Study

Wednesdays at 7pm - Pastor Dell is conducting an in depth study on finding the spiritual roots to our diseases. Come for great teaching and fellowship. You won't believe the things you didn't know.Intercessory Prayer

Now on Thursday evenings at 7pm in the sanctuary.Sunday Morning Prayer

Sunday morning intercessory prayer at 9 a.m. You are more than welcome to join us at the church to pray with us or you may join our prayer service remotely at 9:30am by tapping on Live Signal in the banner above.Sunday morning worship

Sunday morning worship starts at 10 a.m. – Pastor John Pringle. Come out and join us to worship of Lord and Savior. Come expecting great change in your life through the supernatural movement of the Holy Spirit. If you are unable to be with us in person, you may watch the service at 10am live by tapping Live Signal on the banner above.

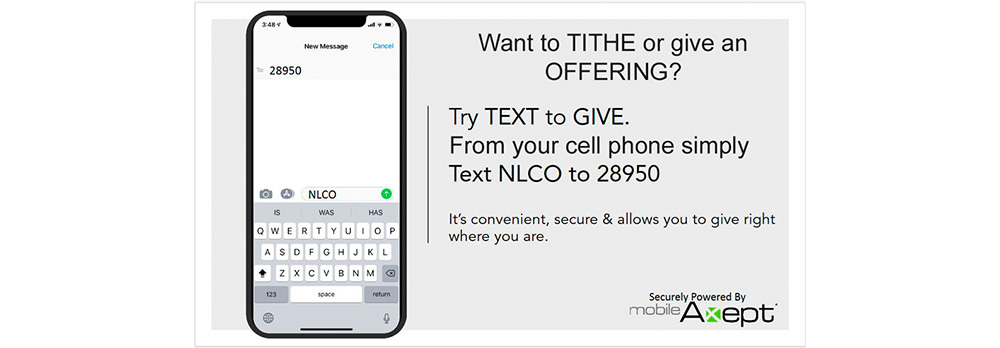

Use your Smart Device to Tithe